As I’m starting to work back from a coworking space, and before Singapore fully reopens its economy in Phase II, I wanted to share some thoughts about the last 2 months. Lockdown started here on April 7th, after already three weeks of advise from local authorities to work from home. Like many others, I guess…

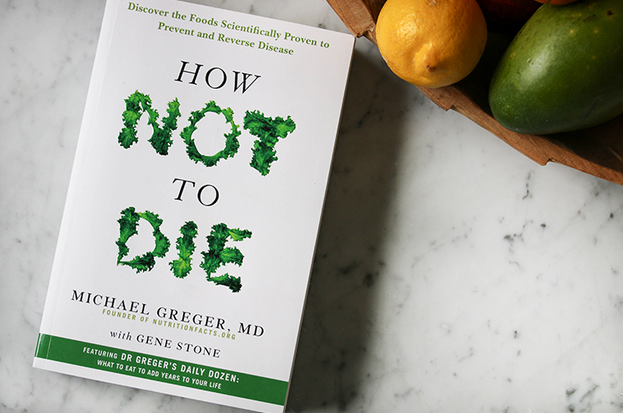

My books of the year (2019)

I barely read anything until I turned 18, and suddenly, I started to read a lot, like really a lot, and I keep clocking about 30 books per year, which makes be both happy (so much good knowledge and deep dives!) and very sad (even if I hit my KPI of living up to 105…

Healthy 2020! Intermittent fasting, low-heart rate running & vegetarian experiments

Three ways to improve your new year: intermittent fasting, vegetarian cooking, and low-heart rate training!

Peter Drucker’s modern thinking for digital leaders

“If you weren’t already in a business, would you enter it today ? If the answer is no, what are you going to do about it?” – it is with this type of questions that Peter Drucker became known as one the leading management consulting practitioners and theorists in the second half of the XXth century….

Tips from 6 weeks of Design Thinking at ESSEC – How to innovate with your users?

Thanks to Xavier Pavie, Associate Academic Director at ESSEC Singapore, I ran a 6-week course in Design Thinking for their class of international students. The departure point was quite exciting: those students were staying in Singapore for a few months only, so they had a fresh point of view on the behaviour of the population….

Corporate Innovation: No One Size Fits All

Companies are not waiting to be disrupted by startups, leading to the push of corporate innovation. 68 of the world’s largest companies on the Forbes Global 500 List have interacted with startups with in the form of hackathons, accelerators, partnerships and venture funds. Our analysis of a dozen recent initiatives, including The Coca-Cola Founders accelerator, GE Garages events and Swire Properties’ coworking…

A History of Innovation in China: The Four Ages of Chinese Entrepreneurs (1970-2016)

China is entering a new stage of development. Expanding overseas to sustain growth, Chinese companies now threaten the GAFA’s territories. In the last two years, news on Chinese companies have frequently hit the headlines: Telecom equipment giant Huawei became #3 behind Samsung and Apple in the smartphone market. Suning Commerce Group accepted a $6 billion tie-up with Alibaba in…

Learning Expeditions in the new “Silicon Valleys” of Asia – How To Do It Right!

Silicon Valley no longer has the monopoly on tech innovation: startups are emerging all over the world with new ideas and technologies, diversifying innovative power to various ecosystems worldwide. Asia in particular is boiling hot and setting new trends. Just think of those two figures from 2016: China’s giant messaging app WeChat processed twice as…

Are you a passive or an active facilitator?

Like many concepts of the knowledge economy, facilitation might sound intangible at best, fuzzy and shallow at worst. And just as other related services such as consulting, brokerage or inspection, a good facilitation depends mostly on the individual doing it, and on key principles and methodology to generate clear outcomes. Over the past few months…

Startups vs Corporates: In 2016, the Empire Strikes Back

In this new world of Unicorns, the closed (but growing) club of $1bn+ startups, it’s definitely a hard time to be a Dinosaur, as MNCs are often dubbed in comparison. They’re slow and take months, if not years, to go from the idea to the product, as R&D seems unfit to “fail fast” and iterate…